We believe that corporate governance is one of the most important aspects of management. As a basic principle of management, we strive to improve the management efficiency of the entire group and conduct thorough governance by enhancing the management of group companies and by strengthening our auditing system. We also disclose adequate information at appropriate times in order to maintain the transparency and soundness of management.

By conducting prompt and appropriate decision making, and through our internal governance function, we are fulfilling our social responsibility as a company, while building strong relationships of mutual trust with our shareholders, investors, customers, employees, the local community, and other stakeholders.

Board of Directors

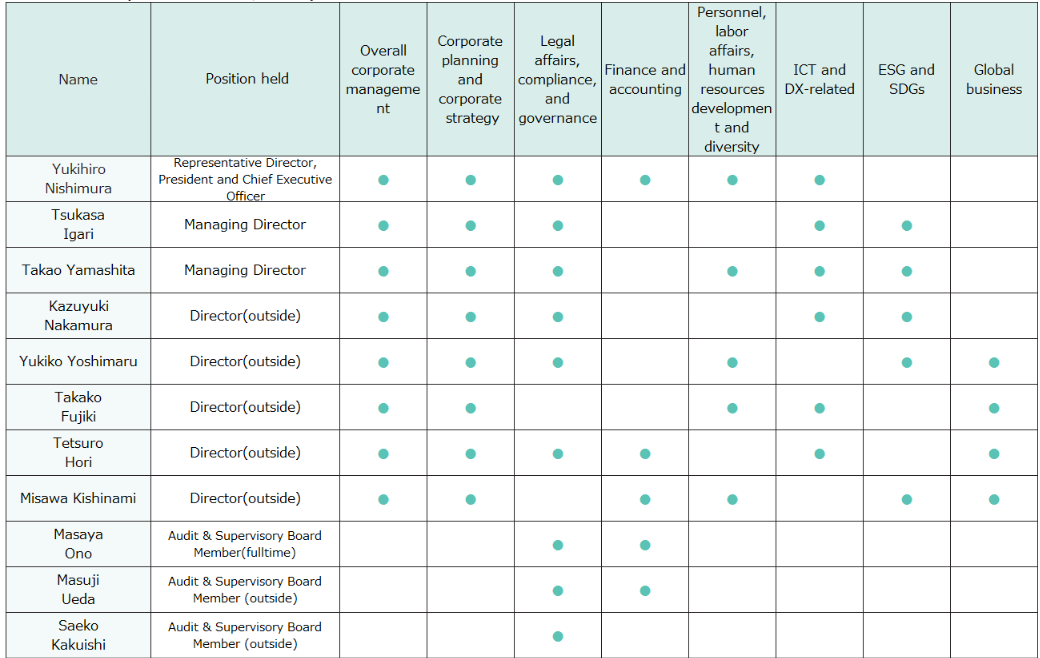

Our Board of Directors consists of persons who are well versed in the relevant businesses and have knowledge in management. The number of members on the Board must be no more than 10, with no less than one-third of the members appointed having to be outside directors. In nominating Directors, etc., the company formulates a draft after taking into consideration the knowledge, experience, ability, etc., required of Directors in light of the management strategy, and the Nomination Committee carries out deliberations, followed by deliberation by the Board of Directors to determine candidates.

Our Board of Directors establishes business strategies, business plans, and other business policies, creates an environment where appropriate risk-taking by the management is supported, and carries out effective oversight of the management.

The Board of Directors leaves daily management tasks that are not subject to the Board’s resolution to the executive directors, and receives reports from them on the status of their respective tasks and on business issues. The directors provide feedback and opinions on these reports, while outside directors provide advice, etc. from their independent stance.

Audit & Supervisory Board

More than half of the members of the Audit & Supervisory Board are outside auditors. Besides fulfilling their responsibilities as auditors from an independent standpoint, they also liaise closely with the company’s outside directors, working to strengthen oversight of company management, and focusing on enhancing corporate governance.

Nomination Committee

The Nomination Committee is composed of at least three members, including the representative director and outside directors. The committee submits reports and recommendations to the Board of Directors regarding the appointment and removal of directors and auditors. The Board of Directors makes its decisions in line with the content of these reports. The committee is chaired by an independent outside director.

Remuneration Committee

The Remuneration Committee is composed of at least three members, including the representative director and outside directors. The committee submits reports and recommendations to the Board of Directors regarding decisions on the amount of performance-based monetary remuneration and performance-based stock remuneration to be awarded. The Board of Directors makes its decisions in line with the content of these reports. The committee is chaired by an independent outside director.

We transitioned to a pure holding company system on January 1, 2006, under which the function of executing operations was transferred to group companies and group management has been promoted.

The Board of Directors of the holding company is engaged exclusively in the “development of group strategies,” “optimal allocation of the group’s management resources,” and “supervision of execution of the group’s operations.” Meanwhile, directors of group companies assume the role and responsibility of executing operations based on the group strategies. Through this system, we intend to speed up management decision-making and to strengthen supervisory functions, thereby working on the development of an efficient and agile management structure.

We also strive to keep track of the status of execution of operations and take prompt and necessary action by holding regular meetings of the Management Meeting, in addition to monthly meetings of the Board of Directors and regular meetings of the Audit & Supervisory Board. On top of that, in order to enhance the set of internal control functions, we hold meetings of the specialized committees where necessary, as well as promoting fair corporate activities while securing high transparency with respect to issues common to group companies, with support from the Management Staff Unit. Furthermore, we strive to ensure that the management policies for the entire Group are known to all members of the group, by holding the annual “Meeting to Present Management Policy” attended by executive members of group companies.

We have formulated the Basic Policy on the Establishment of the Internal Controls System, to ensure that the operations of Daiwabo Holdings and our subsidiaries are conducted appropriately in accordance with the Companies Act.

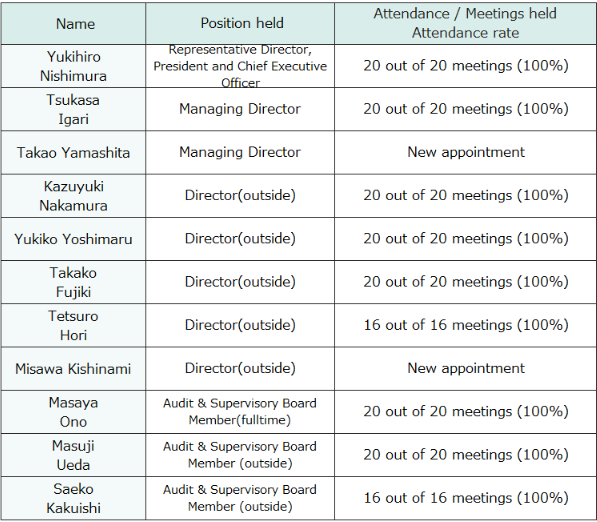

In order to evaluate and analyze the effectiveness of the Board of Directors as a whole for FY2023, we conducted a questionnaire survey on all directors and auditors during the period from mid-April to mid-May 2024, and discussed the summarized results of the survey at the Board of Directors meeting.

The questionnaire contained questions broadly categorized into, among others: the composition of the Board of Directors; the holding of the Board of Directors meetings; matters required to be submitted or reported to the Board of Directors; deliberation at the Board of Directors meetings; support to officers; and the respondent’s own efforts. Each of the categories contained individual questions to be answered.

The survey results touched on the adjustment of the items deliberated on by the Board of Directors, with more time being allocated for discussion of matters concerning corporate value enhancement over the medium to long term, such as business portfolio management, and the initiation of measures to improve how Board meetings are held, with the adoption of a dual subcommittee structure for discussion of important issues. The overall evaluation was that, although there is still room for continued discussion and improvement, steady improvement had been made. However, some respondents noted that there was a need to enhance the quality of discussion regarding management plan progress status and regarding operational performance, and a need to expand discussion of important matters such as M&A projects.

The number of members on the Board of Directors, the composition of the Board, the frequency at which the Board meets, the support system for the Board, etc. were positively evaluated overall. We understand that we have secured the effectiveness of our Board of Directors as a whole. Based on these results, we intend to continue our efforts to activate the Board of Directors and to enhance its supervisory function, among other things.

The basic policy for the company’s remuneration scheme for its directors is: to increase their incentives to improve the company’s performance and increase the company’s corporate value over the medium to long term to maintain a level of remuneration that allows the company to acquire and maintain excellent human resources and to ensure the transparency and objectivity of remuneration for directors.

Specifically, remuneration for executive directors comprises (i)base (fixed) remuneration, (ii)performance-based monetary remuneration, and (iii)performance-based stock remuneration.

Remuneration for outside directors consists only of base (fixed) remuneration.

The amounts paid to each director is kept within the limit of the total amount decided on by the Shareholders meeting.

The amounts of performance-based monetary remuneration and performance-based stock remuneration is decided on by the Board of Directors in accordance with report and recommendation by the Remuneration Committee, which was established as an advisory body for the Board of Directors, with at least 3 memberships comprising the Representative Director and President and outside directors.

Remuneration for auditors consists only of base (fixed) remuneration.

The amounts paid to each auditor is kept within the limit of the total amount, which was decided on the Shareholders meeting,

decided on by the Audit & Supervisory Board through discussion by the auditors.

The amount of basic remuneration (fixed remuneration) will be set according to the position and responsibilities of each Director, and will be paid monthly as a fixed monetary remuneration.

The remuneration level will be set with reference to objective remuneration survey data from external specialized institutions, etc., taking into account the economic and social situation and the Company’s business environment and business performance.

Every year, the Representative Director and President will determine at the Board of Directors after discretionary resolution by the Representative Director and President whether the level of remuneration for each position complies with the above basic policy.

Performance-based monetary remuneration is paid at a fixed time every year.

The degree of achievement of target values such as consolidated operating profit, etc. are set as indicators, and the amount of such remuneration is calculated based on the previous fiscal year’s performance.

Performance-based stock remuneration is paid at the time of retirement as a reward linked to the achievement of performance targets and the improvement of corporate value over the medium to long term.

It consists of a performance-unlinked portion and a performance-linked portion.

The performance-unlinked portion will be set to approximately 30% of the total share-based remuneration.

The maximum amount of the performance-linked portion will be set to approximately 70% of the total share based remuneration.

The degree of achievement of target values such as consolidated operating profit, etc. are set as indicators, and the amount of such remuneration is calculated within a range of 100% to 0% of the base amount based on the previous fiscal year’s performance.

To determine the performance-based monetary remuneration and the amount of performance-based stock remuneration, etc., the Remuneration Committee, after a review, will submit its report and recommendations to the Board of Directors, who will make the determination in accordance with the contents of the report.

The respective remuneration ratios for (i) basic remuneration (fixed remuneration), (ii) the performance-based monetary remuneration, and (iii) performance-based stock remuneration for each type of Executive Director will be set to roughly 50 to 35 to 15, assuming maximum performance-based monetary remuneration and performance-based stock remuneration, with the final determination made by the Board of Directors with reference to the objective remuneration survey data of external specialized institutions, etc.

Based on the resolution of the Board of Directors, the Representative Director, President is entrusted with the authority to decide the specific details regarding the amount of remuneration for each individual. This authority consists of the authority to determine the amount of basic remuneration (fixed remuneration) of each Director,

and to formulate a draft plan for the evaluation of Executive Directors in terms of performance-based monetary remuneration and performance-based stock remuneration.

In order to properly exercise this authority, the Representative Director and President who have been delegated above formulate a draft plan for the evaluation of Executive Directors in terms of performance-based monetary remuneration and performance-based stock remuneration,

the Board of Directors will consult with the Remuneration Committee to obtain its report and recommendations

and then determine the amount of performance-based monetary remuneration and performance-based stock remuneration, etc. in accordance with the contents of the report and recommendations.