Daiwabo Holdings Co., Ltd. supports the TCFD (Task Force on Climate-related Financial Disclosures) recommendations*1 and is a member of the TCFD Consortium*2, which is a forum for discussions among supporting companies and financial institutions.

Recognizing global warming and climate change as important management issues, our Group’s basic environmental philosophy calls for protecting the global environment, which is essential for healthy and cultured living, through "Friendly to People and the Environment" corporate activities.By announcing our support for the TCFD recommendations and joining the TCFD Consortium, the Group will actively disclose information based on the TCFD recommendations, and promote its business activities to contribute to sustainable development by reducing the burden on the global environment.

Daiwabo Holdings Sustainability Site “Environmental Activities”

https://www.daiwabo-holdings.com/en/sustainability/environment.html

- 1: The Financial Stability Board (FSB) was established in 2015 at the request of the Group of 20 countries and regions (G20). It assessed the financial impact of the risks and opportunities posed by climate change, and recommended information disclosure on “governance,” “strategy,” “risk management,” and “indicators and targets.” TCFD completed its role and was dissolved in October 2023. However, the final recommendations of TCFD have been taken over by the International Sustainability Standards Board (ISSB), established by the IFRS Foundation, and incorporated in the ISSB standards.

- 2: The TCFD Consortium was established in 2019 as a forum to discuss effective corporate information disclosure and initiatives to translate the disclosed information into appropriate investment decisions by financial institutions, etc.

(The TCFD Consortium website:https://tcfd-consortium.jp/en)

In April 2020, our group established the ESG Promotion Committee, chaired by the Representative Director, who is also responsible for overseeing environmental management including climate change risk, as an advisory body to the Board of Directors to deliberate on environmental, social, and governance issues. The ESG Promotion Meeting has been established as a subordinate organization of the ESG Promotion Committee for practical discussions about and the promotion of activities. Matters deliberated at the ESG Promotion Committee are reported to the Board of Directors with its opinions attached. The Board of Directors resolves matters reported and commented by the ESG Promotion Committee, and gives relevant instructions and supervision.

Regarding important matters related to climate change, centered on disclosed items based on TCFD recommendations in particular, comments and reports are sent to the Board of Directors once or more a year through deliberation at the ESG Promotion Committee as one of the materialities of the Daiwabo Group. Accordingly, an intensive effort is made to push forward with such matters.

If necessary, we report the impact of climate change as a company-wide risk to the Risk Management Committee, and make recommendations.

●Climate change risk management system

Our group recognizes climate change as a medium- to long-term challenge. Therefore, we make analysis using multiple future scenarios based on the 1.5°C and 4°C scenarios, to account for risks and opportunities under a variety of circumstances.

In a world of +1.5°C, regulations to reduce greenhouse gas emissions will be tightened, and the risk of transition will increase due to the progress of low and decarbonization.

On the other hand, in a world of +4°C, physical risks, such as abnormal weather, are expected to increase, although the impact of transition risks, such as regulations, are small.

The scenarios assume the period up to FY2050 and are based on SSP1-1.9, SSP2-4.5, SSP3-7.0, and SSP5-8.5 of IPCC, and NZE and STEPS of IEA.

Assumptions for Scenario Analysis

|

Scenario |

1.5°C° scenario, 4°C scenario |

|---|

|

Target business |

IT infrastructure distribution business, Industrial machinery business |

|---|

|

Time frame |

Short-term (less than 5 years), medium-term (less than 10 years), and long-term (over 10 years) impact |

|---|

Reason for changing the time frame:

Addressing climate change is a global challenge. As the international community moves toward the ambitious goal of achieving carbon neutrality by 2050, we recognize that companies have an increasingly important role to play in realizing a decarbonized society. In our group, the previous FY2030 target served as a critical milestone for accelerating CO₂ reduction efforts. However, to make a lasting contribution to climate change mitigation and the realization of a sustainable society, we believe that long-term, continuous reduction targets and strategies are essential. Therefore, we have expanded our timeline to focus on a new, long-term goal for sustainable greenhouse gas reduction that looks beyond FY2031. The FY2030 target will now serve as a key milestone on this path. As part of our corporate social responsibility, we will continue to actively engage in climate action to contribute to the realization of a sustainable society.

Climate change scenarios

|

Sustainable society with low environmental impact |

Society with environmental degradation |

||

|

Reference scenario |

Transition scenario |

NZE |

STEPS |

|

Physical climate scenario |

SSP1-1.9 |

SSP2-4.5、SSP3-7.0、SSP5-8.5 |

|

|

Temperature rise |

Less than 1.5°C |

4°C or more |

|

|

Abnormal weather |

Curbing intensification |

Long-term intensification |

|

|

Change in economic activities and social structure |

Balancing decarbonization and economic growth |

Economic growth not taking sustainability into account |

|

|

Risk |

Transition risk |

Large |

Small |

|

Physical risk |

Small |

Large |

|

DIS : Daiwabo Information System Co., Ltd. (consolidated)

OM : O-M Ltd. (consolidated, domestic)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*3 Time Frame: Short-term (less than 5 years), medium-term (less than 10 years), long-term (over 10 years)

*4 Financial Impact: As a consolidated group, Extreme (10 billion yen or more), Large (5– less than10 billion yen), Medium (1– less than 5 billion yen), Small (100 million– less than1 billion yen), Minimal (less than 100 million yen)

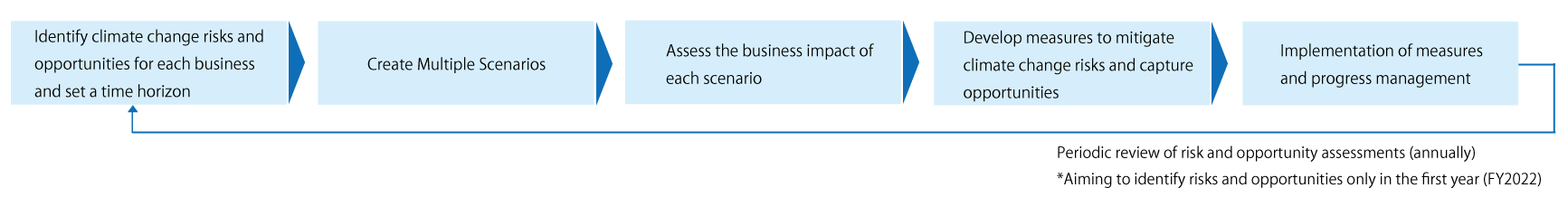

The ESG Promotion Meeting, which promotes issues related to climate change, assesses risks and opportunities related to the impact of climate change, in cooperation with each office of Daiwabo Holdings and Group companies, and monitors the status. Risk assessment is conducted at least once a year and as necessary, and the ESG Promotion Meeting reports and makes recommendations to the ESG Promotion Committee.

The ESG Promotion Committee deliberates on risk assessment, relevant proposed countermeasures, and related indicators and targets at least once a year, followed by reports to the Board of Directors. The Board of Directors resolves matters reported by the ESG Promotion Committee, and gives relevant instructions and supervision.

In the first fiscal year of TCFD disclosure, only risks and opportunities are disclosed. The Group will consider further disclosure of the financial impact.

Recognizing global warming and climate change as important management issues, we have established Group-wide greenhouse gas reduction targets to realize a decarbonized society.

|

Materiality |

Making efforts toward achieving a decarbonized society |

|||

|

KPI |

Short-term target |

Medium-term target |

Long-term target |

|

|

CO2 emissions reduction (Scope1+2) |

GHG emissions reduction (Scope1+2) |

|||

|

Base year |

FY2013 |

FY2022 |

||

|

Target |

Target year |

FY2030 |

FY2035 |

FY2050 |

|

Target value |

-31% |

-55% |

Carbon neutral |

|

|

Scope |

Group (domestic) |

Group (domestic and overseas) |

||

|

Progress as of the end of FY2024 |

-20% vs. FY2013 |

-6% vs. FY2022 |

Implementation and study of various specific measures to achieve carbon neutrality |

|

|

Self evaluation* |

★★★★☆ |

★★★☆☆ |

★★★☆☆ |

|

※Self evaluation

|

★★★★★ |

Goal achieved |

|

★★★★☆ |

Progressing beyond plan |

|

★★★☆☆ |

Progressing as planned |

|

★★☆☆☆ |

Some delays compared to plan |

|

★☆☆☆☆ |

Overall delays compared to plan |

Short-term target

Scope

IT Infrastructure Distribution Business: Daiwabo Information System Co., Ltd. (consolidated)

Industrial Machinery Business: O-M Ltd. (consolidated, domestic)

Daiwabo Holdings Co., Ltd. (non-consolidated)

Excluding Alphatec Solutions Co., Ltd. and some bases

CO2 emissions

Scope 1: Direct emissions from the company itself

Scope 2: Indirect emissions from the use of electricity supplied by other companies

Medium to long term target

Scope

IT Infrastructure Distribution Business: Daiwabo Information System Co., Ltd. (consolidated)

Industrial Machinery Business: O-M Ltd. (consolidated, domestic and overseas)

Daiwabo Holdings Co., Ltd. (non-consolidated)

GHG emissions

Scope 1: Direct emissions from the company itself including other than CO2

Scope 2: Indirect emissions from the use of electricity, cold water and hot water supplied by other companies